Typically the Forex market, identified for its tremendous liquidity and prospective for profit, will be an exciting entire world that attracts aiming traders from most walks of existence. However, diving into Forex trading may often feel mind-boggling for beginners. With so much information offered, it can be challenging to be aware of in which to start. Anxiety not, that guidebook is designed in order to unlock the insider secrets of Forex trading, offering you the vital tools and knowledge to set you on the route to trading achievement.

In this particular comprehensive guide, we are going to cover everything an individual need to know about Forex trading. From understanding the basic terms and navigating the particular complexities of foreign currency pairs, to discovering effective trading strategies and managing risks, you'll learn the fundamental concepts in order to become a self-confident trader. Whether you aim to trade part-time or are usually considering a a lot of the time career, mastering these types of key topics can help you create a strong groundwork in Forex trading and enhance your odds of consistent revenue.

Best Forex Trading Tactics

Selecting the best trading strategy is vital for success found in the Forex market. One popular technique is day trading, where traders open and close roles within the same trading day to monetize on small price movements. This technique requires an eager sense of timing, quick decision-making skills, and the capability to monitor marketplace trends continuously. Day time traders often make use of technical analysis plus real-time market info to make educated decisions shortly before executing trades.

Another efficient strategy is swing trading, which involves holding positions regarding several days or perhaps weeks to profit from larger selling price shifts. This technique allows traders to be able to avoid the pressure of constant checking that day trading entails, making that suitable for individuals with full-time jobs or even other commitments. Swing action traders often analyze market trends in addition to use chart patterns to identify prospective entry-and-exit points, putting attention on broader market movements as opposed to quick fluctuations.

Scalping can be a high-frequency trading strategy that seeks to generate small profits from quite a few trades throughout the day. Scalpers typically hold opportunities for just a few seconds or minutes, depending upon quick trades to accumulate significant gains. This tactic demands a large level of focus, precise execution, in addition to low transaction fees, making it more desirable for traders with life experience and a powerful understanding of market characteristics.

Picking a Forex Broker

Selecting a reputable Forex broker is important for your trading voyage. from this source have to be regulated by simply a recognized economic authority, providing the sense of security and trust. Search for brokers that have a robust background and optimistic reviews from all other traders. Consider their trading conditions, like advances, commissions, along with the leverage they offer, because these factors will straight impact your potential profits and deficits.

Another aspect is typically the trading platform offered by the broker. A user-friendly and reliable trading program makes it less difficult to execute trades swiftly and efficiently. Features such while advanced charting instruments, market analysis, in addition to customer support could enhance your trading experience. Additionally, check whether or https://yamcode.com/unlocking-forex-your-final-beginners-playbook-to-be-able-to-currency will be accessible on different devices, including mobile phone, as this versatility can be helpful for traders in the go.

Lastly, take into account the various consideration types and services available. Many brokerages provide multiple account options focused on distinct trading styles and even experience levels. Select a broker that aligns with your current trading strategy, whether you are working day trading or possessing positions longer. Don't forget to take advantage of demonstration accounts to check the broker's solutions and evaluate when they meet the trading needs before committing real capital.

Comprehending Forex Market Examination

Forex market analysis will be crucial for dealers aiming to help to make informed decisions and grow their trading success. There are two primary forms of analysis utilized in Forex: basic analysis and technological analysis. Fundamental research focuses on financial indicators, geopolitical situations, and central financial institution policies that can impact the significance of stock markets. By understanding these factors, traders might better predict long term trends and industry behavior. For example, a new strong economic record may lead in order to currency appreciation, while political instability may cause depreciation.

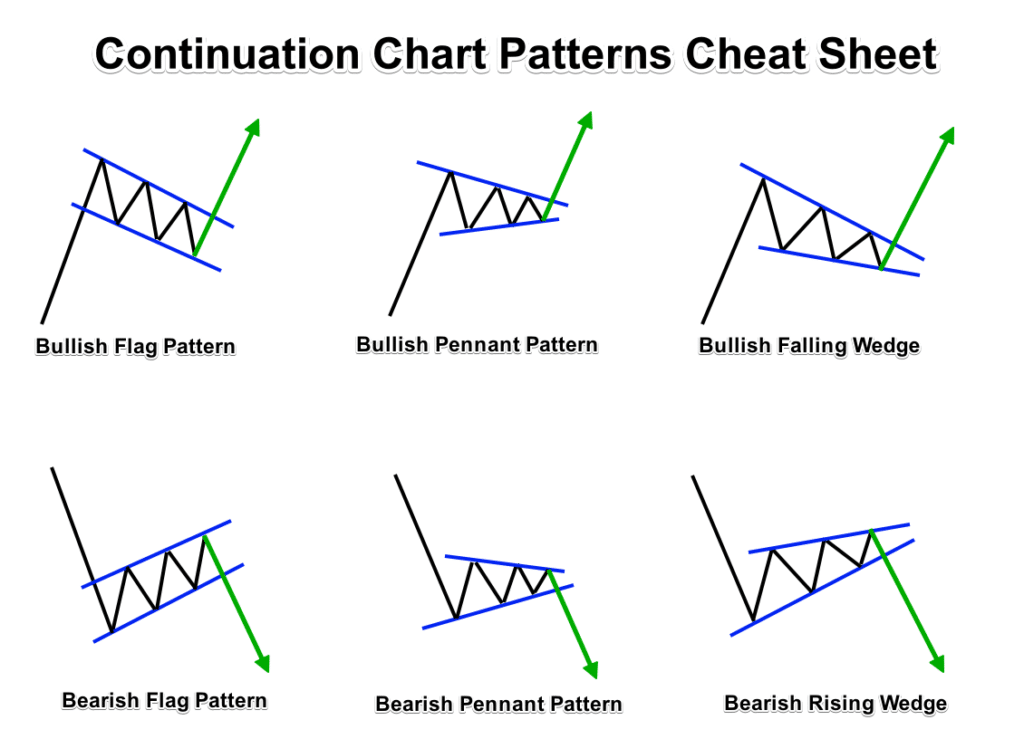

On typically the other hand, complex technical analysis involves examining famous price patterns and market data. Traders use charts in addition to various indicators to distinguish trends, support and even resistance levels, plus potential reversal factors. Tools such since moving averages, Fibonacci retracements, and energy indicators help dealers find optimal entrance and exit details. This approach is particularly useful for short-term investors, as it permits them to capitalize on small cost movements in the market.

Combining both fundamental and technical analysis may give traders a new more comprehensive being familiar with of the Forex market. By staying informed about financial news and utilizing technical tools, traders can develop the robust trading strategy that incorporates both market sentiments in addition to price movements. This particular dual approach aids in making computed decisions, ultimately resulting in more consistent income in Forex trading.